The Fever-Pitched Housing Market

In parallel with a historic spike in unemployment, the pandemic also turbo-charged the housing marking. The median house price in the US has boomed to record levels, exceeding its former 2006 peak. This surge has arisen from widespread work from home policies, lockdowns of city centers, and shifts to the outdoors. With the housing market being a strong source of dynamism for the economic recovery, it will boost construction and materials jobs, entrench remote work's prevalence, and possibly make city centers more affordable.

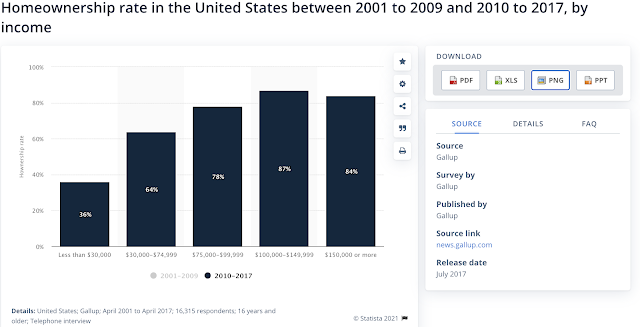

Work from home and greater affinity for space are some reasons why people are trying to purchase a home. On the other side of the equation, low interest rates designed to stimulate the economy have incentivized people to take out home and mortgage loans. The cohort of home-buyers is typically higher-income individuals with more flexible work conditions. For those moving from cities into rural areas, work from home options are a likely enabler. It is therefore important to note that changing labor supply decisions, available to certain groups, are influencing home purchasing.

Strong demand for new homes is lifting up sectors all along the supply chain. For example, lumber prices are up 188% since the pandemic began, and lumber production is at a 13 year high. The construction sector added 111,000 jobs in March; job openings in the sector are up 45% compared to February 2020. Strong labor demand will likely push wages up for construction and materials workers. And even if higher wages push firms to substitute in technologies and machines, investment in capital will boost manufacturing jobs. Median pay in the construction industry is $36,000, just above the US median of $31,000, and this translates into medium-paying jobs amidst a landscape of job polarization. Construction jobs typically require just a high school degree, making the field accessible to much of the population.

Purchasing a home is one of the most significant investments an individual makes, so the demographic shifts of people moving into new homes will not likely revert to pre-pandemic norms. With housing markets in areas like Idaho and North Carolina being some of the most popular, a general shift to more spacious and rural regions will cement remote work's prevalence. Work from home will reduce housing demand for denser cities, so downtowns may become more affordable, allowing those working lower-paying jobs to move back in. Pre-pandemic, high costs of living have been displacing lower-income individuals and forcing people into hours-long commutes. Cities have been trying to counter this displacement by raising minimum wages. The pandemic's reduction of urban housing demand could, therefore, reduce the pressure/need to increase local minimum wages in cities.

While cities could become more affordable, the booming housing market will likely worsen inequality. The home ownership rate in the US is roughly 66%, and the gains of rising home prices will only really be reaped by current home-owners. Lower-income individuals are more likely to rent housing, and tightening credit standards due to the housing boom will prevent many from transitioning to home ownership. This will trap people in still-costly cities. The pandemic's lockdowns have also mainly hurt service and lower-paying sectors, so while the housing surge enriches property owners, many others are facing missed rent payments.

Sources:

- https://fortune.com/2021/03/20/lumber-prices-2021-chart-when-will-wood-shortage-end-price-of-lumber-go-down-home-sales-cost-update-march/

- https://www.wsj.com/articles/march-jobs-report-unemployment-rate-2021-11617314225

- https://www.wsj.com/articles/the-pandemic-ignited-a-housing-boombut-its-different-from-the-last-one-11615824558

- https://www.wsj.com/articles/how-to-buy-a-home-2021-how-much-house-can-i-afford-11617400553?mod=searchresults_pos7&page=1

Comments

Post a Comment